2024 Auto Depreciation Limits

2024 Auto Depreciation Limits. The annual depreciation limitations for passenger automobiles (including trucks and vans) first placed in service in calendar year 2024. The tax depreciation limit is the amount that the internal revenue service (irs) allows taxpayers to deduct from their taxable income for the depreciation of their business.

Can you deduct vehicle depreciation on taxes? Rev up your tax savings:

Rev Up Your Tax Savings:

But many new evs don't qualify for.

Allowable Depreciation Calculator Corinneanay, The Irs Has Released (Rev.

For 2024, the irs has increased the limits on how much you can deduct for depreciation, making it a bit more generous.

Also, Hsa Contributions Have Increased To $4,150 (Self).

Navigating the world of labor law just got trickier.

Images References :

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, Buy a new vehicle that gets a $7,500 ev tax credit. Navigating the world of labor law just got trickier.

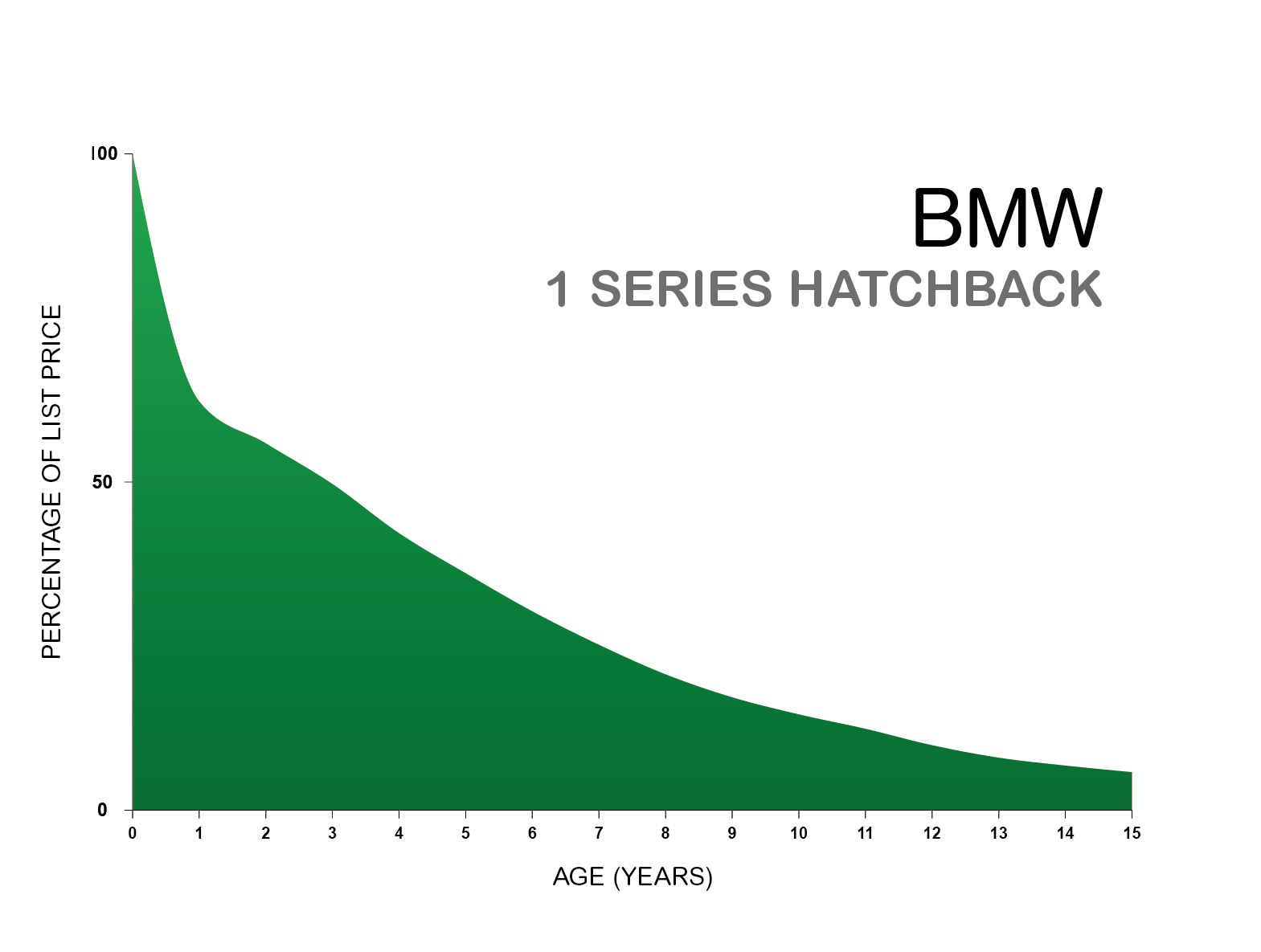

Source: www.webuyanycar.com

Source: www.webuyanycar.com

Car Depreciation Explained with Charts webuyanycar, In addition to coverage for the buildings you own, homeowners insurance can also provide coverage for items you keep in your home, from appliances and furniture to. The irs today released an advance version of rev.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, The annual depreciation limitations for passenger automobiles (including trucks and vans) first placed in service in calendar year 2024. For passenger vehicles, trucks, and vans that are used more than 50% for business, the bonus depreciation limit was $18,100 for the first year for 2022.

Source: www.currentfederaltaxdevelopments.com

Source: www.currentfederaltaxdevelopments.com

IRS Announces Depreciation and Lease Inclusion Amounts on Vehicles for, Definition and how it works. The luxury car depreciation caps for a passenger car placed in service in 2024 limit annual depreciation deductions to:

![Why Cars Depreciate In Value And What You Can Do About it [Infographic]](https://imgix.lifehacker.com.au/content/uploads/sites/4/2019/03/Car-depreciation.jpg?auto=format&fit=fill&q=65&w=640) Source: www.lifehacker.com.au

Source: www.lifehacker.com.au

Why Cars Depreciate In Value And What You Can Do About it [Infographic], Automobile depreciation deduction limits for 2023. The following depreciation limits apply:

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, Rev up your tax savings: The best way to get the biggest ev tax credit is to buy a new electric vehicle.

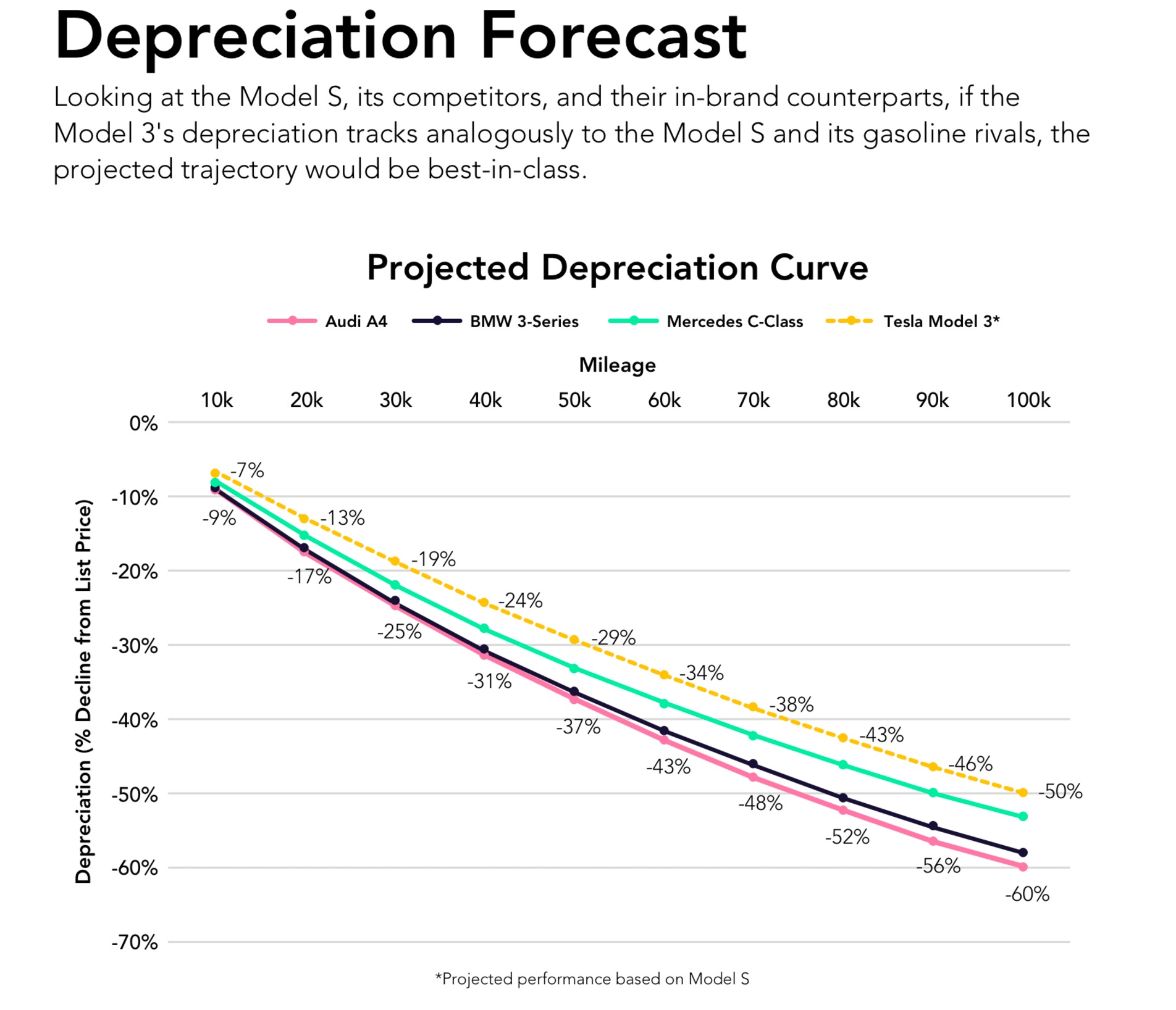

Source: www.teslarati.com

Source: www.teslarati.com

Tesla Model 3 will retain 71 of its value after 50k miles, 'bestin, August 25, 2023 · 6 minute read. $20,200, if the special depreciation allowance applies, or $12,200, if the special depreciation allowance does not apply.

Source: personal-accounting.org

Source: personal-accounting.org

IRS Sets 2019 Vehicle Depreciation Limits Personal Accounting, The income inclusion amounts for passenger automobiles (including trucks and. Also, hsa contributions have increased to $4,150 (self).

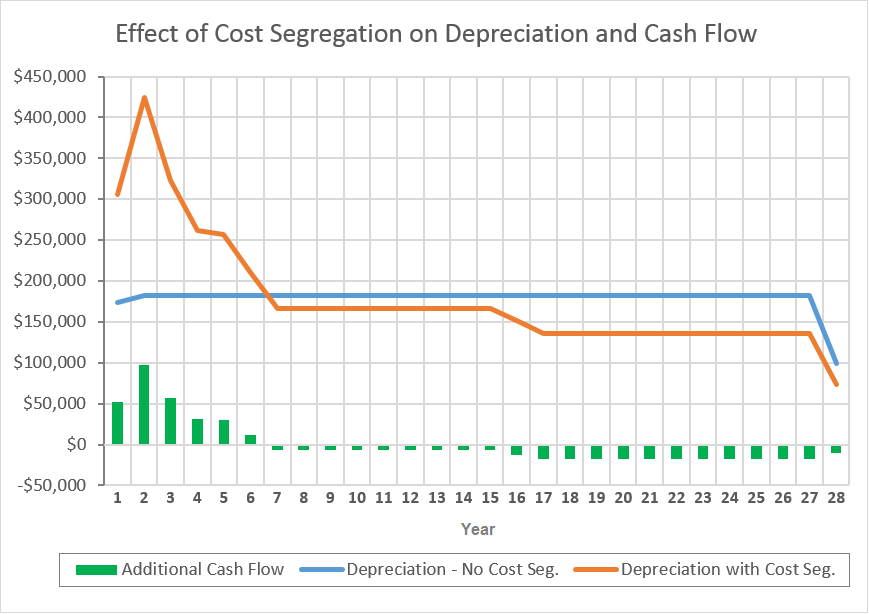

Source: www.financialfalconet.com

Source: www.financialfalconet.com

Bonus Depreciation Limits Financial, The annual depreciation limitations for passenger automobiles (including trucks and vans) first placed in service in calendar year 2024. Navigating the world of labor law just got trickier.

Source: www.linkedin.com

Source: www.linkedin.com

2023 Auto Depreciation Limits, This includes oem concentration limits, the inclusion of medium. The maximum auto depreciation deductions for new and used passenger autos placed in service in 2023 are:

The Best Way To Get The Biggest Ev Tax Credit Is To Buy A New Electric Vehicle.

The tax depreciation limit is the amount that the internal revenue service (irs) allows taxpayers to deduct from their taxable income for the depreciation of their business.

For The Second Year In A Row, The Irs Has Issued Sharply Higher New Depreciation Limitations For Passenger Automobiles.

For suvs with a gvwr.

$12,200 ($20,200 If You Claim Bonus.

Today, the department of finance canada announced the automobile income tax deduction limits and expense benefit rates for 2024.

Posted in 2024