Current Mileage Reimbursement Rate 2025 Ohio Bwc

Current Mileage Reimbursement Rate 2025 Ohio Bwc. May require companies to reimburse for certain other expenses, but not necessarily mileage. An official state of ohio site.

February 1, 2025 beginning on january 1, 2025, the standard mileage rates for the use of a personal vehicle is 67 cents per mile driven for business use. Ohio’s mileage reimbursement laws are like new york’s in that there is no specific rate that businesses are required to reimburse employees, but it is widely accepted that the irs standard rate is the proper rate to use.

The Internal Revenue Service (Irs) Determines This Figure Yearly By Looking At A Complex Web Of Factors, Including Economic Indicators, Fuel Prices, And.

This 3.9% rate reduction was made possible by declining injury claims and relatively low medical inflation costs by ohio’s.

Other States And Jurisdictions Like Iowa, Montana, New York, Pennsylvania, And Washington, D.c.

The responsibility for the content of this file/product is with the state of ohio bureau of workers’ compensation.

There Is No Rate Specific To Ohio;

Images References :

Source: dorettewjobie.pages.dev

Source: dorettewjobie.pages.dev

Canada Kilometer Reimbursement 2025 Cati Mattie, Columbus — ohio’s public employers will pay nearly $8 million less in premiums next year to the ohio bureau of workers' compensation (bwc) thanks to a rate cut that will go into effect jan. Mileage reimbursement rate for 3rd quarter fy 22;

Source: vaclaimsinsider.com

Source: vaclaimsinsider.com

How to Submit a VA Travel Reimbursement Claim Online (7Step Process), Discover the 2025 updated compensation rates for ohio's workers' compensation, including ttd and ppd rates. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Source: rodieqmelodie.pages.dev

Source: rodieqmelodie.pages.dev

2025 Irs Vehicle Mileage Rate Jess Carmelle, As an employer, you (or your authorized party) can view your detailed premium rate information by policy number using the following options. For state fund employers, 2023 premium installment schedules and rates exhibit are now available on the bwc website.

Source: climate-pledge.org

Source: climate-pledge.org

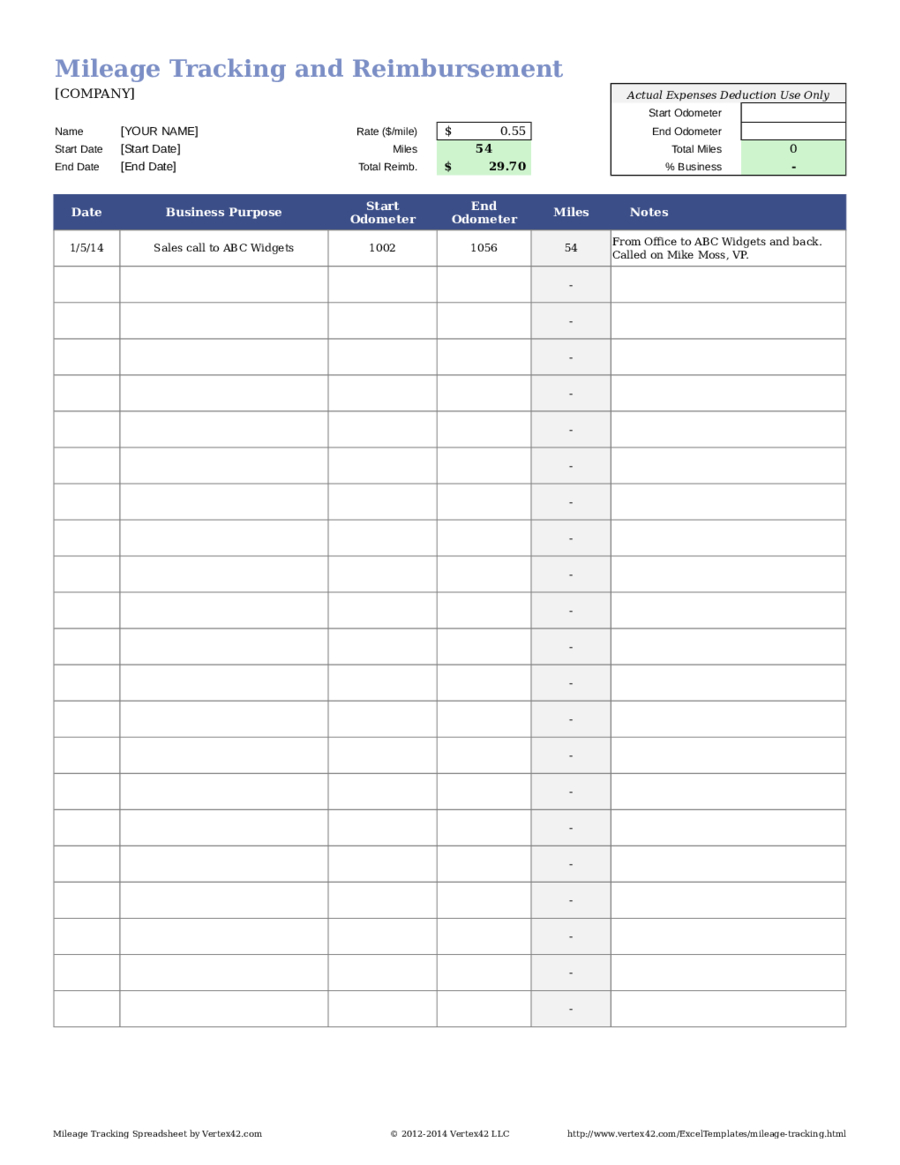

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, An employer with more claims or more severe claims. The ohio bureau of workers' compensation allows medical providers to look up fees for specific services using cpt codes and modifiers.

Source: hrwatchdog.calchamber.com

Source: hrwatchdog.calchamber.com

Mileage Reimbursement Rate Increases on July 1 HRWatchdog, Mileage reimbursement rate for 3rd quarter fy 22; The ohio bureau of workers' compensation allows medical providers to look up fees for specific services using cpt codes and modifiers.

The Mileage Reimbursement Rate for Businesses AttendanceBot, May require companies to reimburse for certain other expenses, but not necessarily mileage. The internal revenue service (irs) determines this figure yearly by looking at a complex web of factors, including economic indicators, fuel prices, and.

Source: db-excel.com

Source: db-excel.com

Fuel Log Excel Spreadsheet inside Monthly Mileage Log Hola Klonec Co, As an employer, you (or your authorized party) can view your detailed premium rate information by policy number using the following options. Other states and jurisdictions like iowa, montana, new york, pennsylvania, and washington, d.c.

Source: cardata.co

Source: cardata.co

Ohio Mileage Reimbursements Cardata, The ohio bwc recently proposed an overall decrease in the statewide base rates of 10% for private employers in the policy year beginning july 1, 2022. To 5:00 p.m., please call the.

Source: use.expensify.com

Source: use.expensify.com

Update your IRS mileage rate for 2025 Expensify, May require companies to reimburse for certain other expenses, but not necessarily mileage. Effective january 1, 2025, the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile for all business miles driven from january 1, 2025, through dec.

Source: www.driversnote.com

Source: www.driversnote.com

The current IRS mileage rate See what mileage rates for this year, These new funds will support rate increases of around 31% from current rates for most services as of january 1, 2025, and 38% from current rates as of july 1, 2025. What is the ohio mileage reimbursement rate in 2023?

Mileage Reimbursement Rates Reimbursement Rates For The Use Of Your Own Vehicle While On Official Government Travel.

This information covers the period of july 1, 2023 through june 30, 2025.

Businesses Operating In The State Are Encouraged To Use The Federal Rate Of 65.5 Cents As A Guideline.

This 3.9% rate reduction was made possible by declining injury claims and relatively low medical inflation costs by ohio’s.